- Client portfolios contain no hidden costs.

- We take no commission on sales and accept no retrocession fees (kickbacks) from third parties.

- We consistently choose cost-effective investment solutions.

- Our fee structure is designed in such a way that Palomar Asset Management has no incentive to perform frequent transactions within a client portfolio.

Fees

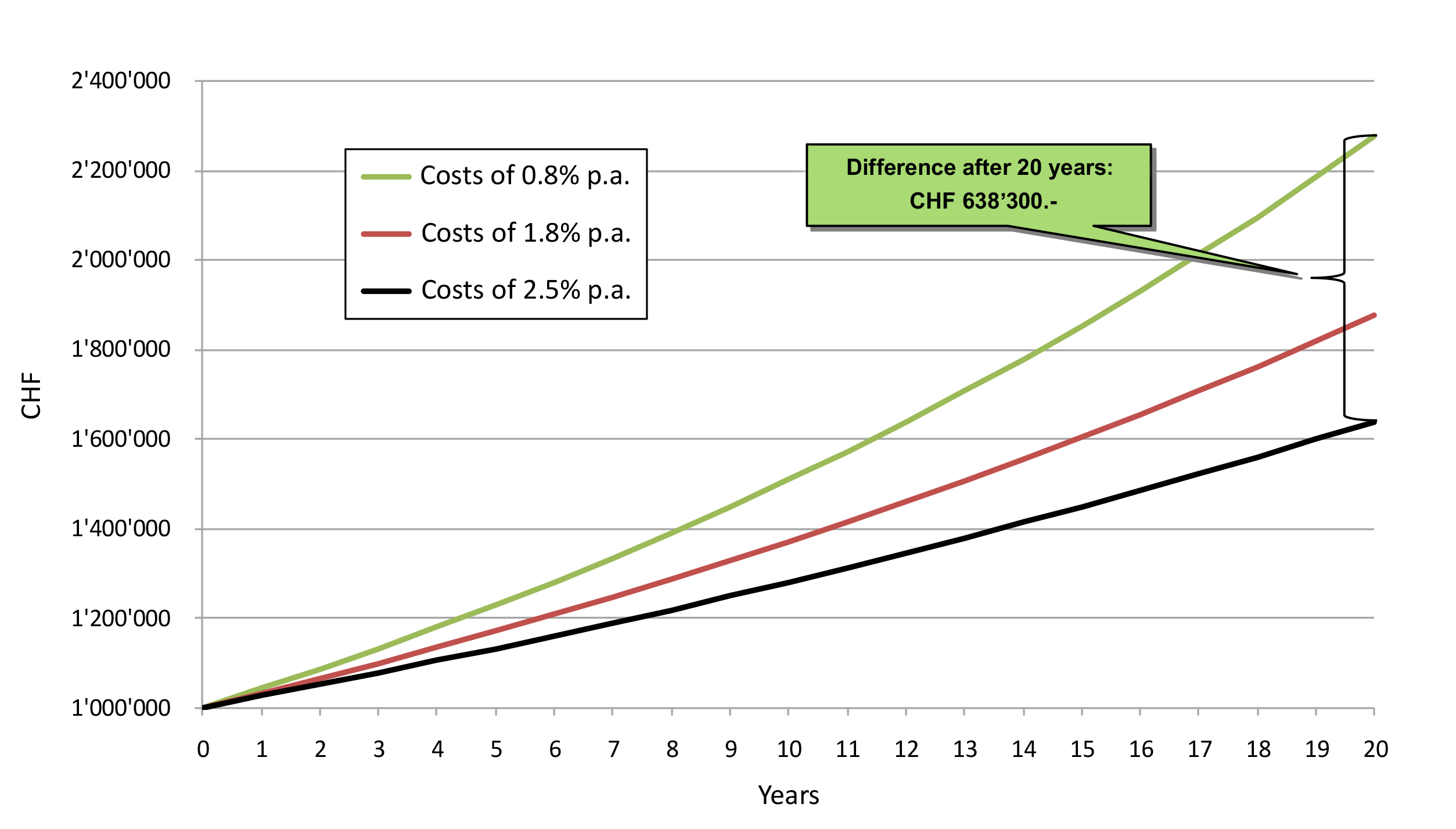

As part of our business philosophy, we strive to maintain costs as low as possible for our clients, with the positive effect of long-term asset increase.

Cost minimisation

Custodian bank fees

- Palomar Asset Management negotiates best possible custodian fees for its clients.

- Clients are charged a reduced administration fee.

- A ticket fee or a reduced transaction fee is charged additionally.

Palomar Asset Management fees

- In accordance with our company philosophy, our fees are comparatively low.

- Palomar Asset Management receives a percentage management or advisory fee, depending on the type of mandate and size of portfolio involved.

Factors affecting capital formation

This graph shows the development of assets of CHF 1m (one million Swiss francs) over 20 years, given different annual costs. The comparison relates to identical investment strategies with a 5 per cent annual gross return.